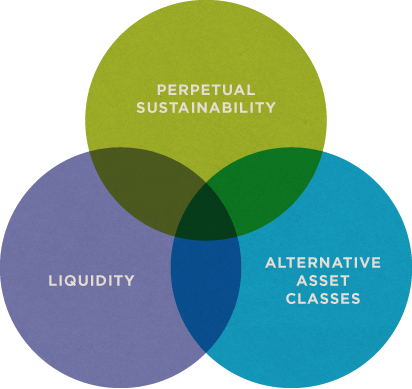

Endowment Model

The endowment model is designed to provide for equity-like returns and to overcome the dual drags of inflation plus spending while tempering volatility through the use of uncorrelated alternative asset classes. We are unique in our implementation in that our firm maintains full liquidity while implementing the endowment model.

Perpetual Sustainability

To achieve perpetual sustainability we focus on investing in uncorrelated asset classes that generate returns in excess of the dual drags of inflation and spending. An organization that fails to achieve investment returns that outpace their spending rate run the risk of spending themselves out of existence in real terms. The spending rate for U.S.-based charities has been around 8 percent annually.

Liquidity

Utilizing liquid investments gives our portfolio the flexibility we need to move freely between opportunities in each asset class, and the option to readily exit any investment that no longer meets our criteria. By exclusively investing in public securities, our clients are not forced to fund costly illiquid investments, even in times of market turmoil.

Alternative Asset Classes

In addition to the traditional asset classes of domestic and foreign equity, Town Lake Capital Management utilizes investments that mimic “alternative” asset classes. Alternatives may have a historic return profile exceeding inflation plus spending but are expected to perform independent of stock indices like the S&P 500.