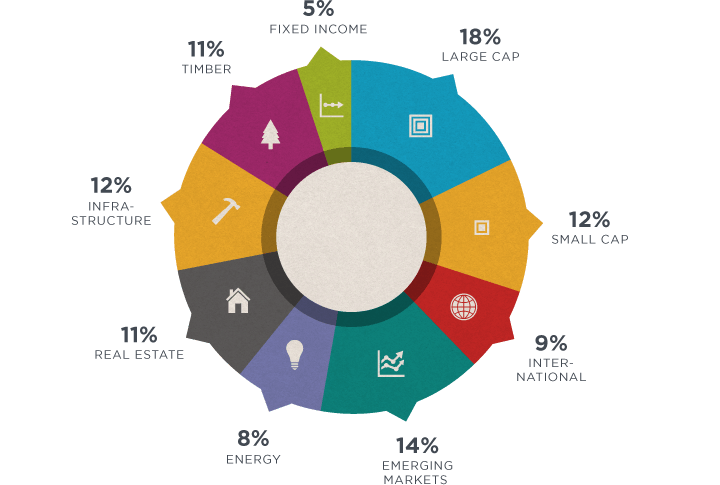

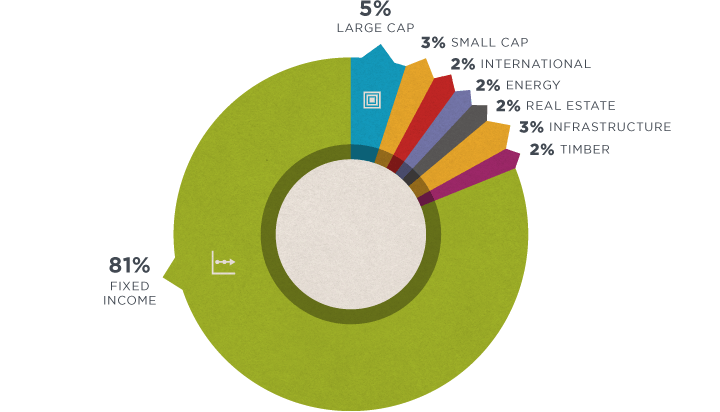

Sample Aggressive

Time Horizon:

Greater than 10 years

Primary Objective:

Aggressive growth

Risk Tolerance:

High Risk

Liquidity Needs:

None

Expected Volatility:

High

Graphic to the right is for illustration purposes only and may not be representative of our actual recommendation.